Financial inclusion

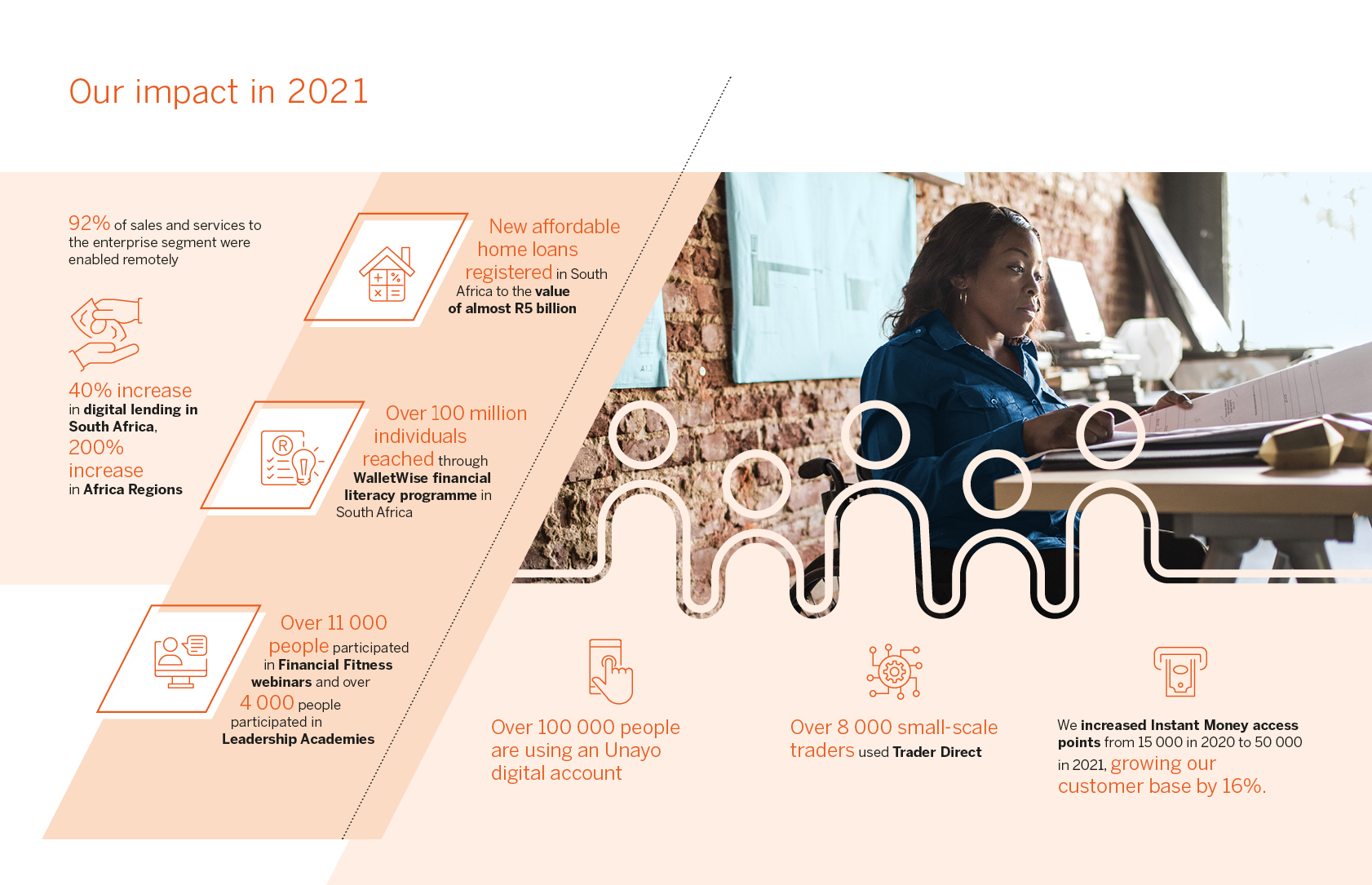

Financial inclusion assists economic and human development and reduces inequality. We provide accessible and affordable digital solutions for under-banked and unbanked individuals, entrepreneurs and small businesses, enabling them to transact conveniently and cost-effectively, save and deal with unexpected emergencies.

Accessible and affordable mobile phone-based solutions for under-banked and unbanked individuals

Digital solutions for entrepreneurs and small businesses to support business formalisation and growth

Home Services, including mortgages for affordable housing

Reducing transaction fees

Insurance products to help people and business owners cope with life’s uncertainties

Consumer education and financial literacy to help people make informed decisions

Improving financial inclusion among women