Rand rate reform

The global financial landscape is evolving, and South Africa is at the forefront with the Rand Rate Reform. Driven by the South African Reserve Bank (SARB), this initiative aims to transition from the Johannesburg Interbank Average Rate (JIBAR) to a more robust benchmark rate known as the ZAR Overnight Index Average (ZARONIA). This transition impacts various financial instruments and requires careful planning. We are committed to supporting our clients through this journey.

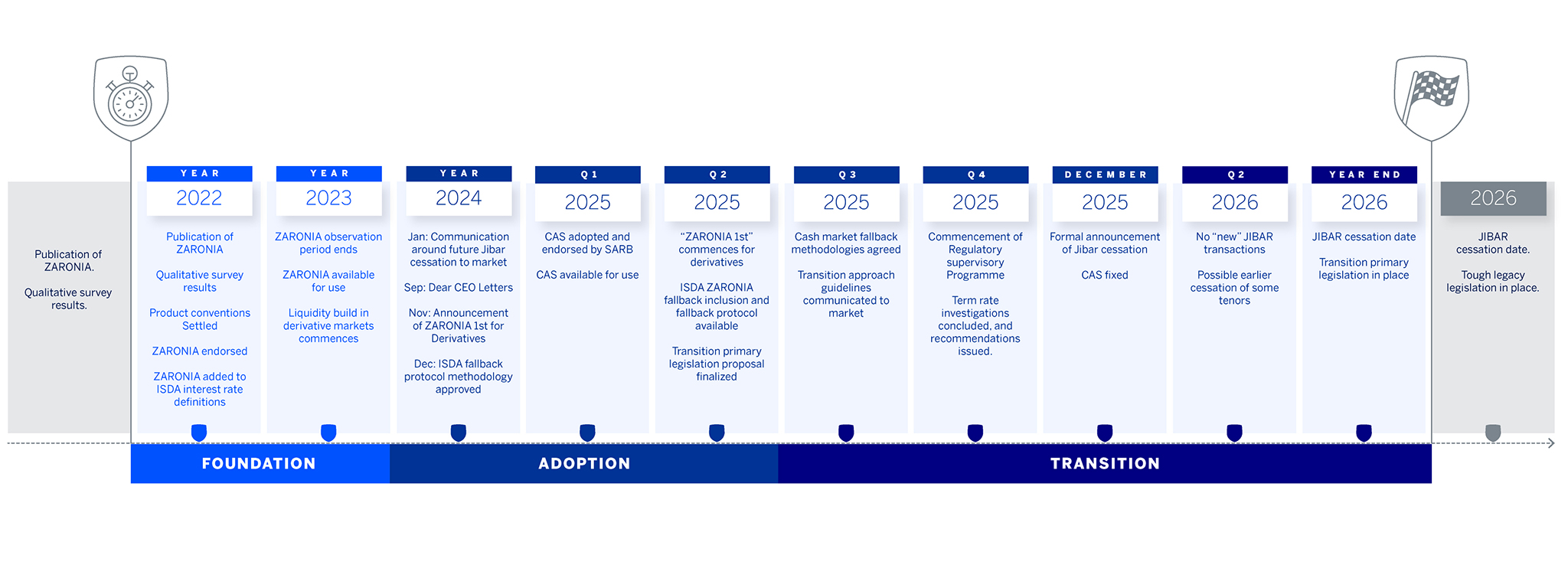

What is the MPG Timeline for the Rate Reform Program?

The MPG timeline can be viewed in three phases: the Foundation, Adoption and Transition phases. The Foundation phase concluded at the end of 2023. Subsequently, the Adoption phase focusses on the various elements required to facilitate the uptake of new ZARONIA trades in the market.

The Transition phase will kick off with the formal announcement of the JIBAR cessation date, expected in Q4 2025. This will be followed by the final publication of JIBAR (or JIBAR cessation) at the end of 2026 as depicted in the latest Industry Timelines.

The industry often uses widely known interest rates to price, value and measure the performance of financial securities across various markets, including equity, credit, commodity, fixed income, and foreign exchange (FX) markets. These rates are commonly characterised as reference rates as they are often referenced in financial contracts. Some of these rates are determined solely by credible institutions, such as the policy rates of central banks, while others combine inputs from numerous contributors to form indices that are commonly referred to as benchmark rates. Essentially, reference rates tend to reflect wider market conditions, assist in price discovery, and reduce information asymmetry.

Certain benchmark rates are deemed critical as they underpin the pricing of a large volume of financial contracts worth trillions of rands and are used to measure the performance of large investment funds. Consequently, they are deeply embedded in the global financial system and play an important role in the functioning of modern financial markets. Examples of such critical benchmarks include the Secured Overnight Financing Rate (SOFR) and the Johannesburg Interbank Average Rate (JIBAR), which are widely referenced in financial instruments within the South African financial market.

The Johannesburg Interbank Average Rate, known as JIBAR, is one of the most widely used interest rate benchmarks in South Africa. The South African Reserve Bank (SARB) is the administrator of JIBAR, which is widely used as a reference rate that underpins a significant number of financial contracts and valuations. It is published in 1, 3, 6, 9 and 12-month tenors. The 3-month JIBAR rate is the most widely used. The JIBAR benchmarks are calculated using certain South African bank quoted Negotiable Certificates of Deposits (NCD) rates as the inputs to determine JIBAR for each tenor.

In 2012, the news broke that several major banks had been manipulating the London Interbank Offered Rate (LIBOR), a benchmark interest rate that was used to set the prices of financial instruments worth trillions of dollars. The investigation into the LIBOR scandal was led by financial regulators in the US and the UK and involved the participation of key players such as Barclays, UBS, and Royal Bank of Scotland. The investigation found that the banks had been submitting false information about their borrowing costs in order to manipulate the LIBOR rate. This allowed the banks to profit from trades based on the artificially low or high LIBOR rates.

The investigation also revealed that the banks had colluded with each other to manipulate the LIBOR rate. The LIBOR scandal had broader consequences for the financial industry and investor trust. The revelation that major banks had been manipulating a key benchmark rate shook investor confidence and led to a decline in the stock market. The scandal also led to a renewed focus on the need for stronger regulation and oversight of the financial industry.

In recent years, financial markets globally have been implementing the reform of reference interest rates to Risk-Free Reference Rates (RFRs). South Africa as a G20 member is following the global approach adopted by the G20 Financial Stability Board (FSB) of reviewing and amending interest benchmarks to comply with international standards on interest rate benchmarks, as set by the International Organisation of Securities Commissions (IOSCO). Through this review conducted by SARB, JIBAR is seen as not meeting all the required attributes of an interest rate benchmark as determined by IOSCO. One of the key factors, similar to LIBOR, is that JIBAR does not have a significant volume of transactions underpinning the calculation of the rate. Having an internationally credible benchmark will support financial stability in South Africa.

| ZARONIA | JIBAR |

|---|---|

| Near risk-free rate (no implied Bank credit risk) | Built in credit and term premium component |

| Overnight rate | Term rate |

| Backward looking | Forward looking |

| Fully transaction based | Indicative rates |

| Broad array of market participants | Only five contributing banks |

The SARB put in place a Market Practitioners Group (MPG), incorporating public and private sector members to manage the Interest Rate Benchmark Reform programme in South Africa. The SARB is overseeing the JIBAR reform process by collaborating with various industry bodies, including trade associations, financial services firms and public sector entities to map the reference rate reform journey, ensure appropriate communication with the market and facilitate the execution of key deliverables.

The Prudential Authority and Financial Services Conduct Authority will monitor financial institutions progress on transition away from JIBAR, ahead of the cessation date, through a supervisory programme.

The occurrence of an event/s that would result in the future cessation of an existing reference rate, will include for example, an announcement by the regulator or administrator of the permanent discontinuation of an existing rate or where the regulator determines that an existing reference rate is no longer representative.

The expected announcement of the JIBAR cessation date, earmarked for December 2025, will be a trigger event. This event will likely cause the Credit Adjustment Spread between JIBAR and ZARONIA to be fixed and will provide economic certainty to the market on the impact of the transition between JIBAR and ZARONIA for existing transactions. The Credit Adjustment Spreads have been published by Bloomberg (since 8 April 2025) for market use, but they will only be fixed on the trigger event date.

Creating a robust overnight benchmark will improve the financial stability conditions for South Africa. The Bank is actively involved in the work of the MPG by leading and participating in relevant workstreams of the MPG. This ensures that we are actively contributing to industry developments and are able to closely monitor progress with regards to derivative and cash market milestones, governance and regulatory guidelines, legal impacts, market infrastructure requirements to support this reform and various other components. The Bank has set up an internal programme to facilitate the transition process across our Business units and our legal entities. We have also started working closely with our clients on this reform journey.

The SARB MPG has not yet announced if the SAFEX Overnight (O/N) will remain an eligible benchmark. It is uncertain if it meets all IOSCO principles for an interest rate benchmark.

All products using JIBAR as a reference rate will be impacted by the reform, including derivatives, bonds, loans, deposits, structured products, such as certain JIBAR-linked home loan products.

The transition process from JIBAR to ZARONIA or any other reference rates (e.g. Prime) is expected to impact both existing and new transactions:

- Existing JIBAR-linked transactions maturing after the cessation date will need to undergo a transition process, including contract amendments, to cater for the transition away from JIBAR by cessation date e.g. the inclusion of appropriate fallback language or the inclusion of ZARONIA, or another rate, as the new rate from the date of amendment or another agreed date

- New JIBAR-linked transactions entered into prior to, but maturing after, the cessation date will also need undergo a transition process. The relevant documentation should include appropriate fallback language. Alternatively, counterparties can agree to include ZARONIA, or another rate, as the reference rate. This will depend on readiness and/or the regulator’s milestones.

- New transactions entered into after the cessation date will need to reference an alternative rate to JIBAR, such as ZARONIA.

The primary purpose of a credit adjustment is to preserve economic neutrality during the transition from one interest rate benchmark (like JIBAR) to another (like ZARONIA). It is a static adjustment which is added to the new benchmark to minimise unintended economic value transfer between a lender and the borrower after transitioning.

The methodology recommended by the SARB MPG to calculate CAS aligns to the ISDA (International Swaps and Derivatives Association) fallback methodology which is the median of the five-year historical difference between ZARONIA and JIBAR. The CAS has been fixed as of 03 December 2025, following the official announcement that JIBAR will be discontinued from 31 December 2026.

| ZARONIA CAS (%) per tenor | |

|---|---|

| 1M | 0.11420 |

| 3M | 0.16190 |

| 6M | 0.43230 |

| 9M | 0.58300 |

| 1Y | 0.74100 |

Fallback language refers to the contractual legal terms that would apply should a reference rate be discontinued. The discontinuation of a benchmark rate, such as JIBAR, will have an impact on contracts where there is no or inadequate fallback language in place. Entities can address this risk by including language in their contracts which references a replacement rate, such as ZARONIA, that will automatically apply and replace the existing rate upon its cessation or discontinuation or on another agreed upon date prior to the cessation date. This is known as fallback language and is considered to be a “safety net” or “safety belt” as parties can automatically transition to the new replacement rate specified in the fallback language, upon a designated date.

It is encouraged to include robust fallback language in contracts, which includes the appropriate replacement rate. Certain international associations, such as ISDA (for the derivative market) and the LMA (the loan market) have published standardised fallback language for benchmark rates for market adoption and use, including LIBORs and, most recently, JIBAR fallback language, intended to assist with the smooth and effective transition of an existing rate upon its discontinuation to the relevant replacement rate.

Definitions for ZARONIA were included in the 2021 ISDA Definitions in 2023. If counterparties are ready to adopt ZARONIA as a reference rate in new derivative contracts, these definitions can be used, provided that the 2021 ISDA Definitions are incorporated.

On 25 April 2025, the 2021 ISDA Definitions were also updated to include standardised ISDA fallback language for new JIBAR- linked derivative contracts entered into prior to its cessation. This fallback language was reviewed and approved by the SARB and market participants following a consultation process. Any derivative contracts entered into from the 25 April 2025, referencing the 2021 ISDA definitions, automatically incorporate the standardised ISDA fallback language.

The ISDA 2021 Protocol April 2025 Benchmark Module was also published for JIBAR-linked legacy derivative contracts entered into prior to 25 April 2025. If both counterparties adhere to this protocol, the standardised ISDA fallbacks will automatically apply to legacy derivative contracts that reference any version of the ISDA Definitions, including, but not limited to, the 2021 and 2006 versions etc. Adherence to the protocol can eliminate the need to manually amend every impacted legacy derivative contract.

The Bank is continually assessing our impacted JIBAR transactions with clients against the MPG transition timelines and monitoring market developments to facilitate the transition away from JIBAR. All impacted contracts will be identified, reviewed and, where necessary, amended to include the appropriate fallback language, or otherwise actively transitioned to ZARONIA, the successor rate for JIBAR.

The Bank is working closely with clients through our client management teams. We encourage our clients to undertake a similar analysis and review exercise, and to take appropriate independent professional advice (legal, tax, accounting, financial or other) to understand the impact of the discontinuation of JIBAR on their portfolios.

Legacy contracts are existing contracts that reference JIBAR and mature after the date JIBAR is permanently discontinued. Existing JIBAR-linked contracts may be amended to incorporate suitable fallback language or other appropriate language to cater for the transition from JIBAR to ZARONIA prior to or by the cessation date. For example: (i) In respect of derivatives, the ISDA 2021 Protocol April 2025 Benchmark Module will apply if both parties sign-up to this protocol on the ISDA website; and (ii) for loans or deposits referencing JIBAR, contracts will need to be amended, as required (rate switch language has been circulated by the LMA as well as the SARB). Proposed amendments to the Financial Sector Regulation (FSR) Act have been drafted to deal with the treatment of those contracts which have not transitioned by the cessation date (anticipated to be 31 December 2026). The process for National Treasury and Parliamentary approvals of these amendments are currently underway.

The Bank will follow industry standards on transitioning transactions away from JIBAR to ensure a fair transition process. Differences between JIBAR and ZARONIA can give rise to a transfer in economic value between counterparties when transitioning. This difference is as a result of ZARONIA being a near risk free rate which does not incorporate a credit risk premium.

The credit adjustment spread (CAS) aims to mitigate against the risk of transferring economic value when transitioning from JIBAR legacy contracts to ZARONIA. Transitioning JIBAR-linked transactions will require amendment to the legal terms of the relevant contracts concluded between you and the Bank. This can be done bilaterally or for certain products, by participating in a market initiative e.g. applying the standard ISDA fallbacks published under the relevant ISDA fallback protocol in respect of derivative transactions, by signing up on the ISDA website.

If you have JIBAR impacted contracts, we recommend that you seek independent professional advice (legal, tax, accounting, financial or other) on how to most effectively transition away from JIBAR. Please contact your client coordinator to assist with questions and guidance with regards to next steps or for more information.

We recommend that clients begin to put in place a comprehensive transition planning process that aims to ensure a smooth transition away from JIBAR to ZARONIA-linked contracts.

The plans need to consider the following:

- Undertaking an impact assessment of current exposures to JIBAR and working collaboratively with financial institutions, industry bodies and other key stakeholders.

- Reviewing legal agreements and renegotiation of certain legal terms to include fallback provisions.

- Ensuring that systems are updated, and processes are in place to manage ZARONIA exposures.

The Bank will continue to provide updates on industry developments via its website, webinars, emails and forum discussions. We encourage our clients to monitor the Standard Bank, SARB, and other industry bodies publications, and to touch base with client coordinators to obtain further information.

|

The MPG is preparing guidelines on transition approaches for different products including loans, bonds, money markets, derivatives, retail markets. These guidelines should be available in Q4 2025. The industry JIBAR transition plan indicates commencement of active transitioning of JIBAR linked contracts beginning in January 2026, commencing post the cessation announcement which is expected end 2025. An active transition means you transition your JIBAR linked contract to an alternative rate prior to the cessation date. For a passive transition, the JIBAR contract will convert to an alternative rate on the JIBAR cessation date based on implemented fallback provisions. In many cases active transition may be preferable to a passive transition, for example where a client has a portfolio of loans and derivatives which may be better to transition at the same time. National Treasury is preparing legislative amendments to the Financial Sector Regulation Act dealing with the cessation of JIBAR. The amendments are designed to passively transition any JIBAR linked transactions on the JIBAR cessation date to alternative reference rates using credit adjustment spreads. These amendments are expected to be incorporated into law in 2026. Following the process, SARB with provide guidance and regulations to aid the passive transition using the legislative amendments |

Term rates (like JIBAR) are useful as they provide cash flow certainty at the beginning of an interest period. ZARONIA is an overnight rate which makes determining interest for a specific interest period more complex, requiring daily observation of the overnight rate, or reliance on a published (backward looking) index. In certain international markets, term rates have been derived from derivative markets, referencing new alternative reference rates. The MPG is working on determining the feasibility of a term rate in South Africa that could meet the IOSCO principles for interest rate benchmarks. However, it is unclear whether term rates will be available prior to cessation of JIBAR and clients should not rely on a term rate being available at this point in time.

To support clients through this change, the Bank has launched the ZARONIA Interest Rate Calculator. This educational tool is designed to help users understand the impact of ZARONIA on one’s portfolios and offers insights into SARB’s pricing methodology. The tool incorporates other global Risk-Free Reference (RFR) rates, such as Sterling Overnight Index Average (SONIA) for the UK and Secured Overnight Financing Rate (SOFR) for the US, to broaden understanding.

To access the calculator, click here

Access the Risk Free Rate Calculator

We are an Africa-focused, client-led and digitally-enabled financial services organisation.

Our business units are dedicated to understanding and meeting the diverse needs of clients across Africa and abroad.

_Landscape.jpg)